Market analysis finds value in new ultrasound equipment, applications

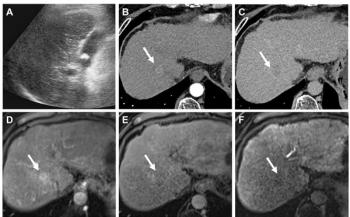

Radiation safety standards are becoming increasingly stringent. Ultrasound systems, however, present no such safety threats, and manufacturers are trying to enhance the versatility of these devices, both in primary and secondary diagnosis. Elastography and therapeutic and contrast-enhanced ultrasound are poised to herald new and more effective means of diagnosis.

Radiation safety standards are becoming increasingly stringent. Ultrasound systems, however, present no such safety threats, and manufacturers are trying to enhance the versatility of these devices, both in primary and secondary diagnosis. Elastography and therapeutic and contrast-enhanced ultrasound are poised to herald new and more effective means of diagnosis.

Many medical research universities are collecting data on individual organ physiology and function, which is paving the way for therapeutic ultrasound. As they provide noninvasive treatment, many smaller companies have emerged that offer organ-specific, therapeutic ultrasound solutions.

A new analysis from

“While the ultrasound market in Europe is saturated and is primarily a replacement one, the therapeutic and contrast enhanced ultrasound segments are projected to experience stable growth,” said Frost & Sullivan research analyst Shriram Shanmugham. “As clinical research becomes more intensive, research facilities and ultrasound companies are forming associations in order to accelerate ultrasound development.”

A major benefit offered by ultrasound systems is that they do not emit any radiation. Moreover, as therapeutic procedures of these systems are noninvasive, patient recovery time is quicker.

However, with the economic recession, many hospitals have had to contend with curtailed budgets. Due to the recession, hospitals have been attempting to save money by either delaying their investments in medical equipment or buying used/refurbished systems. The money saved on equipment is typically spent on maintaining hospital productivity.

“The procurement of used and refurbished systems has become a priority for hospitals that do not have the money to invest in new medical equipment,” Shanmugham said. “Another situation that is hampering new purchases is the trend of hospitals postponing equipment acquisition to the next fiscal year.”

Ultrasound manufacturers should highlight the importance of investing in new equipment. They should provide a detailed portfolio of the transitions expected with ultrasound technology and convince hospitals to look into the long-term benefits accrued from such investments.

“Enhancing customer interaction will be key for manufacturers, particularly currently, at a time of recession," Shanmugham said. “Manufacturers can promote specialized programs that focus on customer involvement, ensuring customer loyalty in the long term.”

Frost & Sullivan also published equivalent research on upper body applications.

Newsletter

Stay at the forefront of radiology with the Diagnostic Imaging newsletter, delivering the latest news, clinical insights, and imaging advancements for today’s radiologists.