Automated Breast Ultrasound Use on the Rise

The market for automated breast ultrasounds is increasing. Here’s why.

Although efforts to identify and treat breast cancer are increasing worldwide in the attempt to decrease mortality rates, the incidence of the disease is still significant. As a result, there’s a bolstered push for technologies that can diagnose these cancers as efficiently and accurately as possible. Many governmental initiatives, such as dense breast notification laws, are also fueling this call.

Automated breast ultrasound systems are among the fastest growing options, according to many industry reports.

Based on data from the

In fact, a

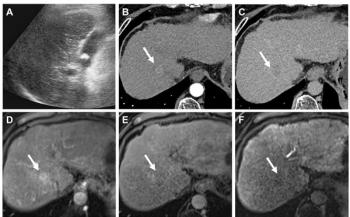

As an alternative to hand-held ultrasound, automated breast ultrasound systems use high-frequency sound waves to produce a 3D image of the breast. While the 3D image helps radiologists interpret images more accurately, this type of system also offers several other benefits. Not only do these systems provide shorter scanning times, but they also reduce operator dependence as the transducer automatically scans the breast. Additionally, they increase reproducibility, consistency, reliability, and sensitivity for each individual breast exams while decreasing human error and bias.

Related article:

According to the report, to help meet market needs-particularly among medium- to small-end users-a growing number of vendors are focusing on developing affordable, integrated technologies. For example, some products offer crystal technology to provide more detailed image resolution and tissue uniformity to create more clarity about the root cause of a finding. Other products focus on improving imaging for women with dense breast tissue.

Currently, based on report results, North America enjoys the largest market share worldwide, approximately 33%. The United States accounts for the most usage, and the value of the American market is estimated to rise to $868.7 million by 2024. That majority North American stake can be attributed to the rising prevalence of breast cancer cases, the growing number of breast cancer diagnostic centers, and the ballooning number of vendor product launches. But, North America isn’t alone in expanding automated breast ultrasound use. Europe and Asia are also expected to experience significant usage growth.

As of 2017, hospital were the largest end users of automated breast ultrasound systems, accounting for 61.3% of the market share. Along with diagnostic centers, these facilities are anticipated to expand their utilization the most due to collaborations between private players and hospital chains, as well as the continued rise in hospital-based breast cancer screenings.

There are several factors currently impacting automated breast ultrasound use, though. For instance, while Medicare will pay for a scan if it is medically indicated, many private payers still do not cover the diagnostic test. Not only does this inhibit a clinician’s ability to order the scan, but it also puts a financial burden on the patient. The out-of-pocket expense for an automated breast ultrasound is, on average, $250.

Additionally, the initial cost of state-of-the-art equipment is also limiting use. On average, a new system can cost roughly $300,000. An overall lack of radiologists and technologists, as well as a need to train these individuals to effectively use the system, can also be an obstacle.

Even with these factors in place, however, report findings point to a sustained and continued automated breast ultrasound system market growth in an effort to provide the highest level of patient care available.

Newsletter

Stay at the forefront of radiology with the Diagnostic Imaging newsletter, delivering the latest news, clinical insights, and imaging advancements for today’s radiologists.